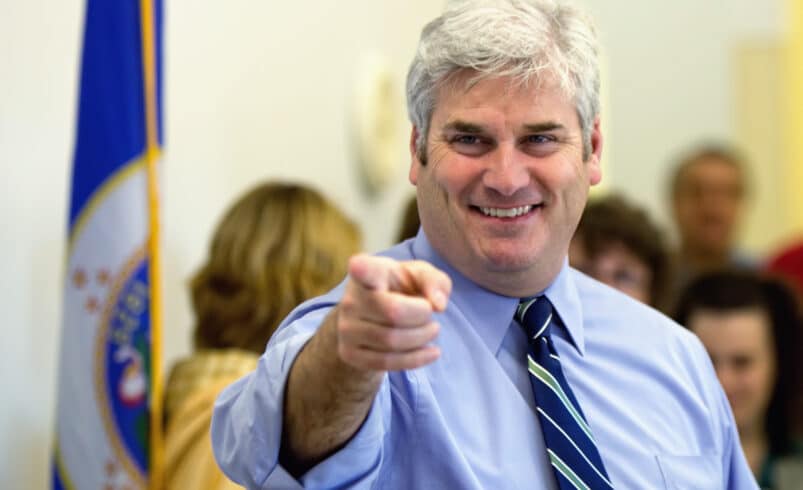

US Congressman Tom Emmer Advocates Limiting SEC’s Crypto Oversight

Key Insights:

- Congressman Emmer advocates restraining the SEC’s authority in crypto regulation to address more pressing industry concerns.

- The proposed amendment reflects a broader effort by Republican lawmakers to reshape digital asset regulation.

- Deputy Treasury Secretary Wally Adeyemo underscores the urgency of addressing crypto-related concerns for national security.

In a significant development within the cryptocurrency industry, United States Congressman Tom Emmer has taken a bold step to limit the powers of the Securities and Exchange Commission (SEC).

On November 8, Emmer proposed an amendment to the Financial Services and General Government Appropriations Act (HR 4664) bill. This proposed amendment seeks to prevent the SEC from using public funds to pursue enforcement actions against the crypto industry until Congress establishes clear legislation granting the agency authority over the sector.

Emmer’s Move to Curb SEC’s Authority

During a congressional hearing, Emmer voiced his concerns about SEC Chair Gary Gensler’s allocation of taxpayer resources. Emmer highlighted that while critical issues within the crypto space still needed to be addressed, Gensler focused on seemingly trivial matters. Specifically, he criticized Gensler for his attention to celebrities like Kim Kardashian while significant problems persisted in the industry, including cases like Sam Bankman-Fried’s alleged Ponzi scheme.

The proposed amendment passed without opposition among lawmakers, reflecting a shared desire to prevent perceived abuses of SEC enforcement against the emerging crypto economy. Emmer argued on X (formerly Twitter) that Gensler should not misuse the agency’s powers to advance a political agenda or potentially drive the digital asset industry offshore.

A Broader Push for Regulatory Reforms

Emmer’s amendment is part of a broader effort by Republican lawmakers to tighten budgetary control over federal agencies. With the deadline for budget expiration approaching on November 17, various initiatives are seeking to reshape the regulatory landscape for digital assets.

In addition to Emmer’s proposal, several other bills await Congressional attention. These include the Financial Innovation and Technology for the 21st Century Act, the Blockchain Regulatory Certainty Act, the Clarity for Payment Stablecoins Act, and the Keep Your Coins Act.

Reducing SEC Chairman’s Salary

Another noteworthy development in this ongoing effort is Representative Tim Burchett’s proposal to drastically reduce the SEC chairman’s salary to a mere $1. Burchett is also advocating for lowering the salaries of other officials who have faced criticism from the Republican Party.

Emmer emphasized that other government bodies, such as the Department of Justice and the Treasury, could significantly manage potential misconduct within the crypto industry. This underscores the need for comprehensive regulatory measures and oversight to address emerging challenges and opportunities in the cryptocurrency space.

Swift Action Needed

Deputy Treasury Secretary Wally Adeyemo has echoed the call for Congress to take swift action to address concerns related to the potential misuse of cryptocurrency in funding illicit activities, especially those linked to terrorism. Adeyemo’s emphasis on the urgency of the matter highlights the growing importance of cryptocurrency regulation in the broader context of national security.

Congressman Tom Emmer’s proposed amendment represents a noteworthy development in the ongoing debate over cryptocurrency regulation in the United States. As various bills and proposals pass through Congress, the future regulatory landscape for digital assets remains uncertain, with stakeholders closely watching for further developments.

The proposed amendment by Congressman Emmer serves as a significant step in addressing concerns within the cryptocurrency industry, focusing on the role and authority of the SEC. While Emmer’s move to limit the SEC’s powers has gained support, it is part of a broader push by Republican lawmakers to reform regulatory practices and ensure adequate oversight in the rapidly evolving digital asset space.

DISCLAIMER: It's essential to understand that the content on this page is not meant to serve as, nor should it be construed as, advice in legal, tax, investment, financial, or any other professional context. You should only invest an amount that you are prepared to lose, and it's advisable to consult with an independent financial expert if you're uncertain. For additional details, please review the terms of service, as well as the help and support sections offered by the provider or promoter. While our website strives for precise and impartial journalism, please be aware that market conditions can shift unexpectedly and some (not all) of the posts on this website are paid or sponsored posts.